Streaming & VOD Vertical in 2026: The Time to Jump In

Streaming and VOD vertical is one of the busiest niches in performance marketing right now – and 2026 is shaping up to be its breakout year. Global video streaming revenue is expected to increase from approximately $191.6 billion in 2026 to more than $865 billion by 2034, with an average annual growth rate of nearly 21%, driven by improved internet access and the ongoing demand for on-demand content worldwide. For affiliate marketing and media buying, this is exactly the kind of dynamic worth leaning into.

This guide walks through how the vertical works, how it differs from other niches, which creatives and funnels convert, and what to keep in mind as you scale.

What the Streaming & VOD vertical includes

The Streaming & VOD vertical in traffic arbitrage is much broader than Netflix-like platforms.

Typical offers and projects in this niche include:

-

Subscription‑based VOD platforms (movies, series, anime, sports archives)

-

Hybrid services with both VOD and live streaming (sports, events, reality shows)

-

Niche platforms: horror‑only catalogs, local‑language libraries, K‑drama hubs, kids’ content.

-

Ad‑supported streaming tiers with upsell to paid plans

-

Aggregators, comparison sites, and “where to watch” guides that send users to partner platforms.

Demand is not slowing down. Global streaming subscriptions are expected to reach around 1.5-1.6 billion SVOD subscriptions by 2026, as users keep shifting from traditional TV to on‑demand libraries. At the same time, SVOD revenue on OTT platforms is projected to surpass $139 billion by 2027.

Add to this a few trends that play directly into your hands:

-

Faster internet and cheaper data in emerging markets

-

Smart TVs and streaming sticks are becoming standard at home

-

Longer “couch seasons” in colder months, when people stay indoors and binge-watch series

Why streaming offers convert

Streaming and VOD work well in traffic arbitrage because they tick all the right boxes:

-

Simple value proposition. “Watch movies/series/sports now, no waiting, no ads, low price” is clear in seconds and doesn’t require education.

-

Impulse behavior. People often subscribe in the moment: saw a trailer, remembered a show, got a recommendation from a friend.

-

Recurring revenue. Many platforms operate on a subscription model, so a single initial deposit can generate several months of revenue if the user remains active.

-

Year‑round demand. There are peaks (winter/fall, holidays, major releases), but the vertical never truly stops.

The overall video streaming market is projected to grow almost 5x between 2025 and 2034. Additionally, the affiliate marketing industry is expected to exceed $20 billion globally by 2026. Together, this gives a comfortable environment for video-on-demand traffic arbitrage: more users, more subscriptions, more budgets.

How to advertise in the Streaming & VOD vertical

In this niche, the goal is simple: maximize first deposits and trial starts while maintaining a sustainable CPA.

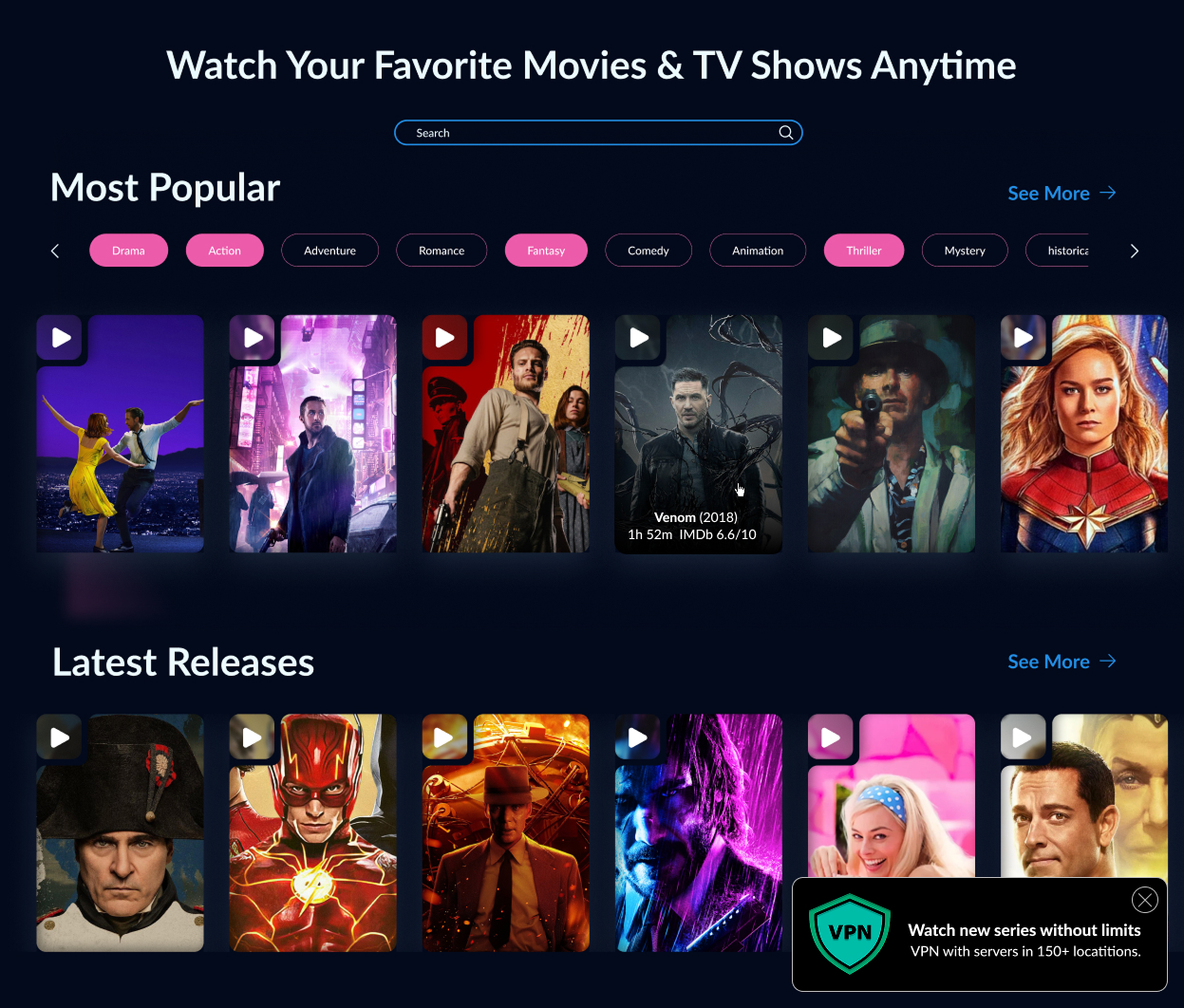

1. Entertaining landing pages

Pre‑landers and landers should speak “content”. Guides and case studies on VOD campaigns consistently show that entertainment‑driven pages beat generic funnels.

What works:

-

Highlight the experience, not the platform.

Phrases like “New movies without waiting”, “Exclusive series you won’t find on TV”, “Full season available from day one” follow angles used in successful streaming landers. -

Use specific hooks.

“Top 10 new releases this month”, “Watch the full season without ads”, “Premiere available only here” mirror content‑first pre‑landers that drive VOD subscriptions. -

Show real interface previews.

Screenshots of the catalog, categories, mobile app, and TV layout – users want to see what they are paying for, and this pattern is common in high‑performing VOD layouts. -

Tap into seasonality.

In winter: “Cozy evenings with new series”. In summer: “Take your favorite shows on vacation” – seasonal angles are specifically recommended in streaming trend overviews.

Funnel types to test:

-

Direct to offer.

Short landing page, sign‑up form, and payment. Good for warm audiences and branded campaigns; this structure appears often in OTT/VOD landing templates. -

Content pre‑lander.

Articles like “Best movies to watch this weekend,” with integrated buttons and cards that link to the platform, are a widely used approach in streaming affiliate marketing. -

Comparison page.

Simple table: “Why this service vs other options” – especially useful for higher‑priced offers, echoing comparison‑style pages used in VOD reviews.

2. Creatives that show what users get right now

Streaming offers are visual by nature, so creatives should support that. Real‑world examples from VOD and live-streaming campaigns often share similar elements.

Use:

-

Thumbnails and posters of trending shows and films (with proper rights or generic lookalikes). Genre‑driven visuals are highlighted as a safe, scalable choice in VOD creative breakdowns.

-

Short lines focused on instant access, not abstract benefits: “Watch tonight”, “All episodes online”, “No cable, cancel anytime” – these snippets closely match the copy used in streaming & VOD affiliate examples.

-

Device focus. Show content on TV screens, laptops, tablets, phones – ideally a mix of 2-3 devices, as suggested in multi‑device VOD best practices.

-

For live streaming offers: highlight live events, countdowns, match days, or premiere dates, a common tactic in live‑stream campaign guides.

Don’t forget that streaming & VOD offers are not limited to the content itself – you can also promote related products and services (VPN, devices, or streaming platforms themselves):

Smart GEO strategies: where to buy traffic

In addition to more obvious Tier 1 market opportunities, one of the most fascinating 2026 strategies is to focus on Tier 2 and Tier 3 GEOs, perhaps in the Asian or LATAM regions, but with a twist.

Here’s what you can do:

-

Run campaigns in Tier‑2 / Tier‑3 countries where CPM and CPC are lower, mobile data is cheaper, and streaming adoption is rising.

-

In your campaign settings, set the browser language to English (ENG) to target expats, frequent travelers, tourists, and international workers.

This gives a good balance: on the one hand, you pay less for impressions and clicks than in classic Tier‑1, on the other hand, you still target an audience with higher purchasing power and a strong habit of paying for subscriptions.

Things to keep in mind: restrictions and compliance

Streaming and VOD ads look cleaner than gambling or adult offers, but they still should comply with a few rules. Industry sources regularly highlight three main risk areas.

1. Copyright and content rights

The most obvious negative trend within this vertical is the presence of unlicensed material.

-

Avoid creatives that clearly promise pirated movies or “all cinema for free forever” – this is an explicit violation of ad policies.

-

Do not use posters, logos, or characters in a manner that clearly violates copyright terms unless you have such rights.

-

Don’t use famous platforms (“better than Netflix”, “free alternative to Disney+”) if this is not permitted with this offer. Many affiliate programs forbid such comparisons.

Even in cases when networks practice light moderation, these promises can cause issues for rights holders and long‑term domain reputation.

2. Geo-targeting and licensing zones

Why can streaming rights be geo‑locked?

-

Some of the platforms are available only in specific countries or regions.

-

Catalogs vary by country, so creatives must match the actual user experience post-sign-up.

Always:

-

check the GEO list and restrictions in the offer description;

-

avoid advertising any promising television shows or movies that are not available in the particular country;

-

split campaigns by region instead of sending global traffic to a single funnel, as recommended in various guides for live stream strategies.

3. Age‑appropriate creatives

Even common streaming platforms can offer 18+ categories (horror, explicit content, niche categories), so:

-

ensure that the creatives are suitable for target setting and GEO;

-

avoid shocking imagery or overly explicit scenes in teasers and banners;

-

comply with local laws with respect to sensitive topics (violence, nudity, political or religious content).

A pro tip: If a concept is close to being considered borderline, it is safer to keep the creative neutral and move edgier elements deeper into the funnel (for example, on a pre‑lander with proper age messaging).

Launch and scaling tips

If you are just starting with streaming affiliate marketing or have only experimented with a few campaigns, the best method is to follow the simple and structured approach, the same pattern you see in the VOD case studies.

Begin with targeted GEOs and simple funnels

-

Choose 1 to 3 GEOs where VOD and live streaming are already mainstream, and the quality of the internet is good.

-

Begin by focusing on mobile viewers first – most users watch on phones or tablets, particularly in emerging markets.

-

Test 2-3 landing page concepts (direct to offer, listicle, comparison page) with the same offer to determine what your audience responds to.

Use formats that match “couch” behavior

-

Popunder: It catches users in the process of surfing film-related pages, then silently opens your offer to be discovered at a later stage – this has been shown in the analysis of VOD advertisement formats.

-

In-page: looks native on content pages and is suitable for entertainment traffic.

-

Push: encourages viewers to engage with new releases, last day to watch, and special promotions – a common topic in the content related to streaming affiliate marketing.

This is where Streaming and VOD vertical in traffic arbitrage excels: users are already in a watch something mode, all you need is to show them a quick, relevant option.

Optimize based on real user behavior

-

Cut GEOs, placements, and formats that do not bring first deposits or trial activations.

-

Raise bids on combinations that deliver stable FTDs and subscription starts.

-

Pay attention to time‑of‑day and weekday patterns: evenings and weekends often outperform other slots for streaming, as noted in VOD trend reports.

Get quality traffic

Streaming and VOD vertical is no longer a secondary niche but is actually one of the key drivers of modern viewing behavior. Projections say that the video streaming industry is on course to hit between $149-212 billion by 2026, growing at an incredible rate through at least 2030. The number of subscriptions as well as the penetration rate of SVOD are on an annual increase.

🎥 Launch your Streaming & VOD campaigns and create funnels that turn traffic into a stable flow of income

So, when you are ready to scale, EVADAV has a publisher base and support team ready to help you take the Streaming and VOD niche to the next level!